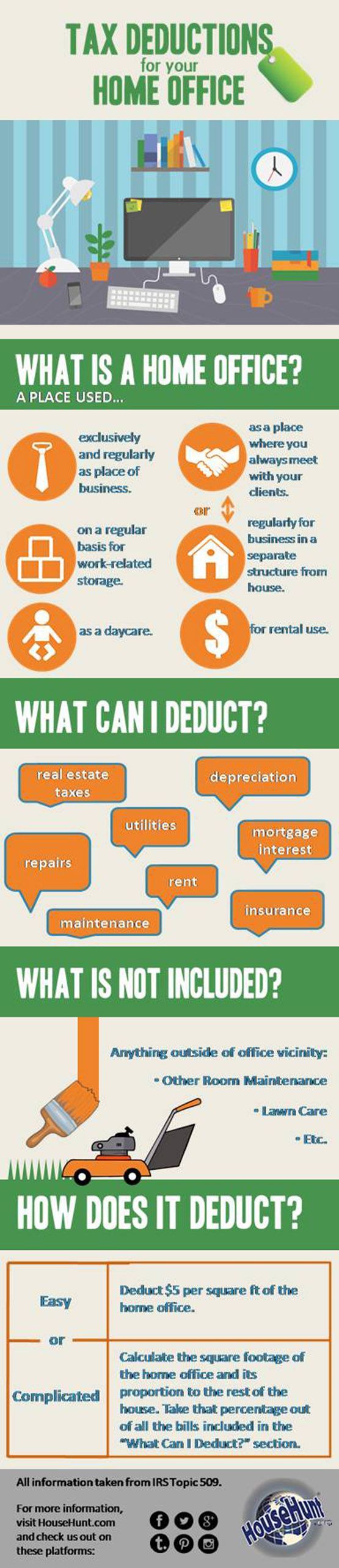

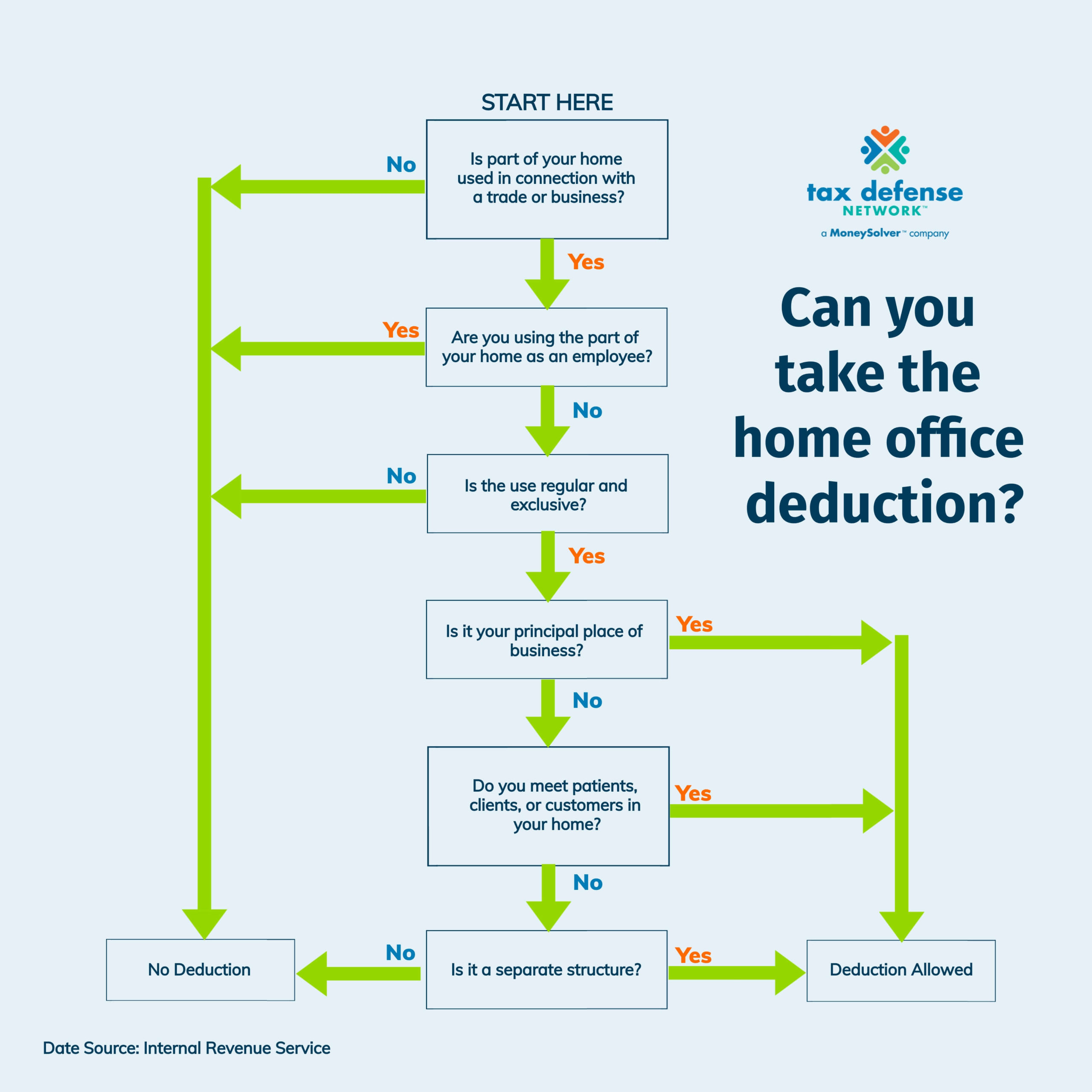

Home Office Deduction For 2025. This deduction is claimed on your personal income tax return. Criteria to consider for the home office deduction: The home office tax deduction allows qualifying taxpayers to deduct certain expenses related to their home office on their tax return.

The year 2025 is expected to bring some changes in the rates for home office expense deductions. Deductions reduce the amount of income.

Home Office Deduction Calculator 2025, You may qualify for the home office deduction if you use a portion of your home for your business on a regular basis. The home office tax deduction allows qualifying taxpayers to deduct certain expenses related to their home office on their tax return.

An Easy Guide to The Home Office Deduction, Details of all home office spending over £25,000 for 2025. Criteria to consider for the home office deduction:

When to claim home office tax deductions Shakespeare Financial Group, Dec 13, 2025 5 min. Are home office expenses tax deductible?

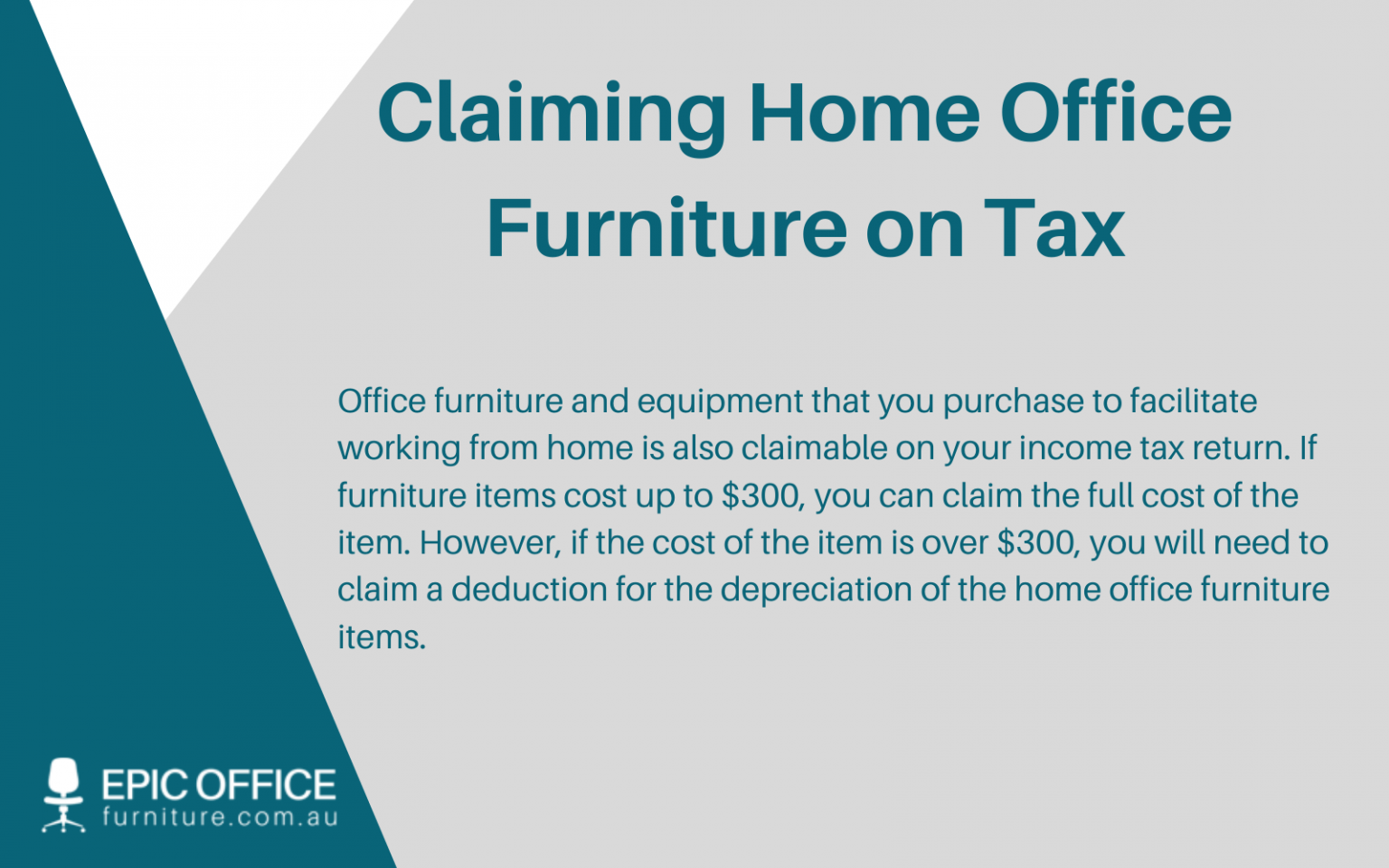

5 Home Office Deductions You Should Know About Epic Office Furniture, You may qualify for the home office deduction if you use a portion of your home for your business on a regular basis. Updated on june 30, 2025.

Simplified Home Office Deduction, Updated on june 30, 2025. Cnbc senior personal finance correspondent sharon epperson.

Save Big Time On Taxes How To Do Your Home Office Deduction Right, Home office expenses may be tax. The irs guidelines for home office deductions are an important aspect to consider when preparing your tax returns for the 2025 tax year.

Freelancer Taxes How to deduct your home office Rags to Reasonable, Home office expenses may be tax. If you qualify for the home office deduction, there are two ways to calculate the tax break, according.

The Ultimate Guide to Home Office Deductions for Tax Savings YouTube, You may qualify for the home office deduction if you use a portion of your home for your business on a regular basis. A home can include a house,.

Home Office Deductions for Psychotherapists, Article continues below this ad. Home office expenses may be tax.

“renters may qualify for valuable tax deductions, depending on the nature of their work, filing, and residency status,” shares.

If you qualify for the home office deduction, there are two ways to calculate the tax break, according.